Navigating Education Tax Credits and Deductions in 2025

April 13, 2025 - 17:56

As the 2025 tax season approaches, students and parents alike can benefit from understanding the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). These credits can significantly reduce the financial burden of higher education.

The AOTC allows eligible students to claim up to $2,500 per year for the first four years of higher education. To qualify, students must be enrolled at least half-time in a degree program and meet specific income thresholds. For 2025, the income limit for full credit is expected to remain around $80,000 for single filers and $160,000 for married couples filing jointly.

On the other hand, the LLC is available for any post-secondary education and offers a credit of up to $2,000 per tax return, regardless of the number of students. Unlike the AOTC, there is no limit on the number of years this credit can be claimed, making it a valuable resource for lifelong learners.

To maximize these benefits, it is crucial to keep accurate records of tuition payments and other qualifying expenses. Consulting with a tax professional can also provide personalized guidance based on individual circumstances.

MORE NEWS

February 20, 2026 - 18:44

OSU-CHS awarded US Department of Education grant for civil discourse projectOklahoma State University Center for Health Sciences (OSU-CHS) has received a substantial federal grant nearing $4 million to lead a national initiative aimed at strengthening civil discourse. The...

February 20, 2026 - 12:09

Indian Lake Board of Education honors Headings, bids farewell to three employeesThe Indian Lake Board of Education convened its rescheduled February meeting this week, with a primary focus on honoring dedicated service and marking the retirement of three long-time staff...

February 19, 2026 - 21:01

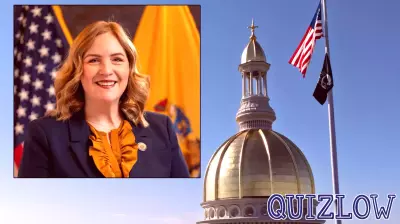

Governor’s pick for education chief sails through confirmation hearingLily Laux, a former high-ranking official within the Texas Education Agency, is poised to become the state`s next Commissioner of Education following a confirmation hearing that saw broad,...

February 19, 2026 - 04:44

Cornerstone University Launches Groundbreaking General Education Core CurriculumCornerstone University has launched a pioneering general education program designed to deeply integrate Christian faith with academic study and civic engagement. The new initiative, named The...